Canada's Most Overlooked Real Estate Investment Opportunity

🎙️ Listen to the Conversation

In-depth discussion about this topic

Calgary’s office market currently provides the most attractive risk-adjusted returns, with unlevered stabilized yields in the mid-to-high teens on assets built within the past 20 years in irreplaceable locations trading at a fraction of replacement cost, and uniquely facing shrinking supply.

In a world chasing yield and resilience, Calgary’s suburban office market stands out as one of the most mispriced and misunderstood real estate opportunities in North America. While headlines continue to parrot the 30%+ downtown Calgary office vacancy rate, investors who look beneath the surface will see a very different picture, one of high-performing suburban assets, double-digit cap rates, and shrinking supply. Calgary, once shaken by the collapse in oil prices and the pandemic-driven shift to remote work, is quietly becoming a contrarian investor’s dream.

The Tale of Two Markets: Downtown Distress vs. Suburban Resilience

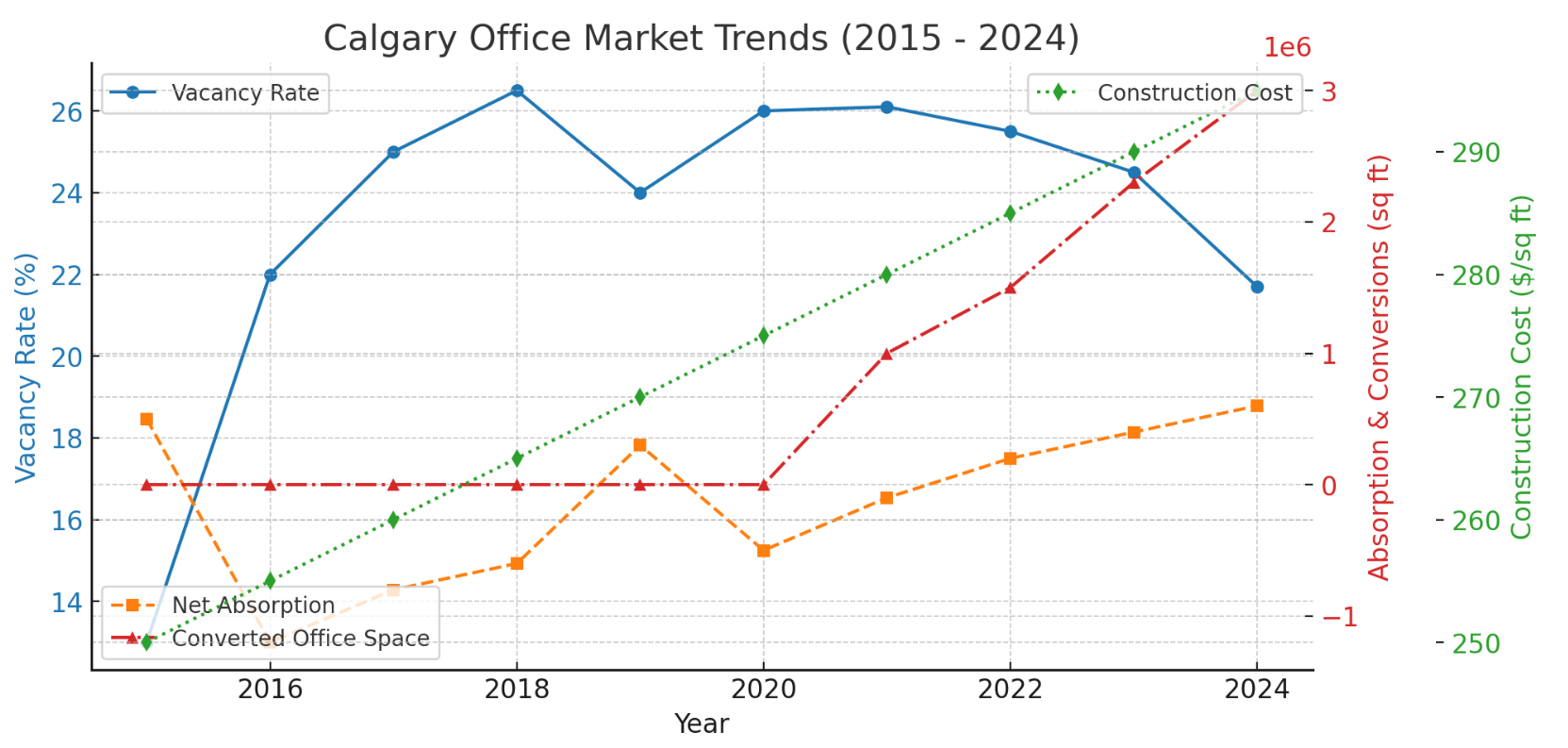

Calgary’s office market is often painted with a broad brush of doom and gloom, with headlines fixating on downtown’s soaring vacancy rates and distressed tower sales. As of Q2 2025, downtown Calgary’s office vacancy rate stands at a staggering 30.7%, driven by large block vacancies in the energy sector (CBRE Canada, Q2 2025). But this narrative misses a critical truth: Calgary’s suburban office markets are thriving, offering low vacancies, rising rents, and a unique opportunity for investors. While downtown struggles, areas like Northwest Calgary are near full occupancy, with vacancy rates as low as 2.5% and rents growing steadily. This stark contrast creates what may be Canada’s most mispriced real estate opportunity, particularly for those seeking high yields and long-term growth.

In this article, we’ll explore why I believe Calgary’s suburban office market is at its bottom, undervalued, and poised for significant upside. We’ll dive into the data, debunk the myths, and highlight why smart money is already moving into this overlooked gem. From robust economic fundamentals to favourable lease structures and restricted supply, the case for investing in Calgary’s suburban offices is compelling and urgent.

The Downtown Dilemma: A Market in Distress

Downtown Calgary’s office market has faced significant challenges, making it a focal point for negative sentiment. According to CBRE, the downtown vacancy rate reached 30.7% in Q2 2025, up 50 basis points from the previous quarter, largely due to energy sector consolidations like Chevron’s exit. Over the past 12 months, downtown has seen negative net absorption of approximately 554,000 square feet, reflecting a persistent loss of tenants. Office towers are changing hands at deeply discounted prices, often at 20 to 25 cents on the dollar compared to their peak values. For example, Bow Valley Square, a 1.6 million square foot portfolio, sold for just $140 million, or about $87 per square foot, well below the estimated replacement cost of $500+ per square foot.

The oversupply of downtown office space has prompted innovative solutions, such as the City of Calgary’s Downtown Development Incentive Program, which has facilitated the conversion of approximately 2 million square feet of office space into residential units, with a target of 6 million square feet by 2031. Projects like the Cornerstone building demonstrate progress, but the downtown market remains a tenant’s market, with flat rental growth (around 0.2% year-over-year) and significant sublease space of 1.9 million

Suburban Strength

In stark contrast, Calgary’s suburban office markets are a picture of resilience and opportunity. The Northwest submarket, in particular, stands out with a vacancy rate of just 2.5%, among the lowest in Canada. Other suburban areas, such as Southeast (4.4%) and Northeast (9.8%), also perform significantly better than downtown. The Northwest submarket recorded positive net absorption of 160,000 square feet over the past year. Rents in these areas are rising, with Northwest Calgary seeing 2.3% year-over-year growth, reaching approximately $32 per square foot gross.c In the Southeast, gross asking rents have increased from $26.19 in 2019 to $33.90 in 2025 (29.4% increase).

The strength of suburban markets lies in their diverse tenant base. Unlike downtown, where energy firms dominate, suburban offices attract tenants from financial services, education, construction, and wellness sectors. Smaller leases (under 5,000 square feet) account for two-thirds of leasing activity, providing stability and reducing the risk of large-scale vacancies. The suburban sublease inventory is minimal, representing only 11% of Calgary’s total sublet space, a record low that underscores tight supply and strong demand.

The Data

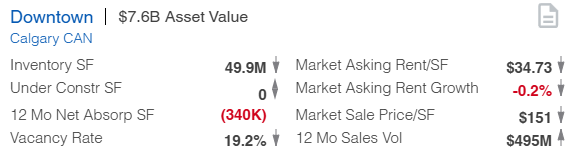

Calgary’s Q2 2025 office landscape is sharply divided. Downtown Calgary is still recovering from a multi-year downturn marked by institutional exodus, spiking inventory, and tenant right-sizing. The numbers are sobering:

- Vacancy Rate: 30.7% (avg. of all leading sources; CBRE, Colliers, JLL, C&W, etc.)

- Net Absorption (TTM): -340,000 SF

- Construction Starts: -0.0 (since 2019)

- Sublease Inventory: 1.9M SF (90% vacated)

- Asking Rent Growth: Flat

- Example of Distress: Bow Valley Square recently sold for $87/SF, a fraction of replacement cost

- City Response: A 6 million SF downtown office-to-residential conversion plan is underway by 2031

Calgary Downtown Office Data - CoStar 2025

Calgary Downtown Office Data - CoStar 2025

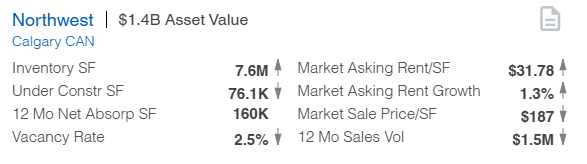

In stark contrast, Northwest Calgary, a key suburban submarket, has emerged as an outperformer:

- Vacancy Rate: 2.5%

- Net Absorption (TTM): +160,000 SF

- Rent Growth: +2.3% YoY

- Construction Starts: 30,000 SF (Avg. YoY since 2019)

- New Supply Absorbed: 114,000 SF

- Lease Profile: 66% of leases are under 5,000 SF, indicating tenant diversification and stability

- Tenant Mix Financial services, education, healthcare, construction, wellness

- Sublease Inventory: 11% of city total

Calgary Northwest Office Data - CoStar 2025

Calgary Northwest Office Data - CoStar 2025

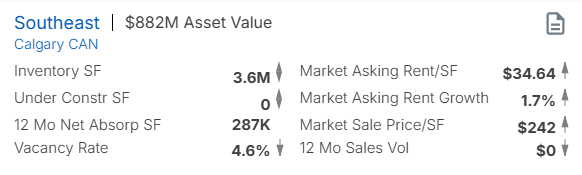

Southeast Calgary, a key suburban submarket, has also emerged as an outperformer:

- Vacancy Rate: 4.4%

- Net Absorption (TTM): +288,000 SF

- Rent Growth: +2.1% YoY

- Construction Starts: 0.0 (since 2019)

- Tenant Mix: Engineering services, education, construction, telecom, logisitcs

- Sublease Inventory: 0.3% of city total

Calgary Southeast Office Data - CoStar 2025

Calgary Southeast Office Data - CoStar 2025

This bifurcation is the market’s loudest signal: suburban Calgary is no longer just a hedge against downtown volatility, it’s the future.

Cap Rate Spreads at Generational Highs

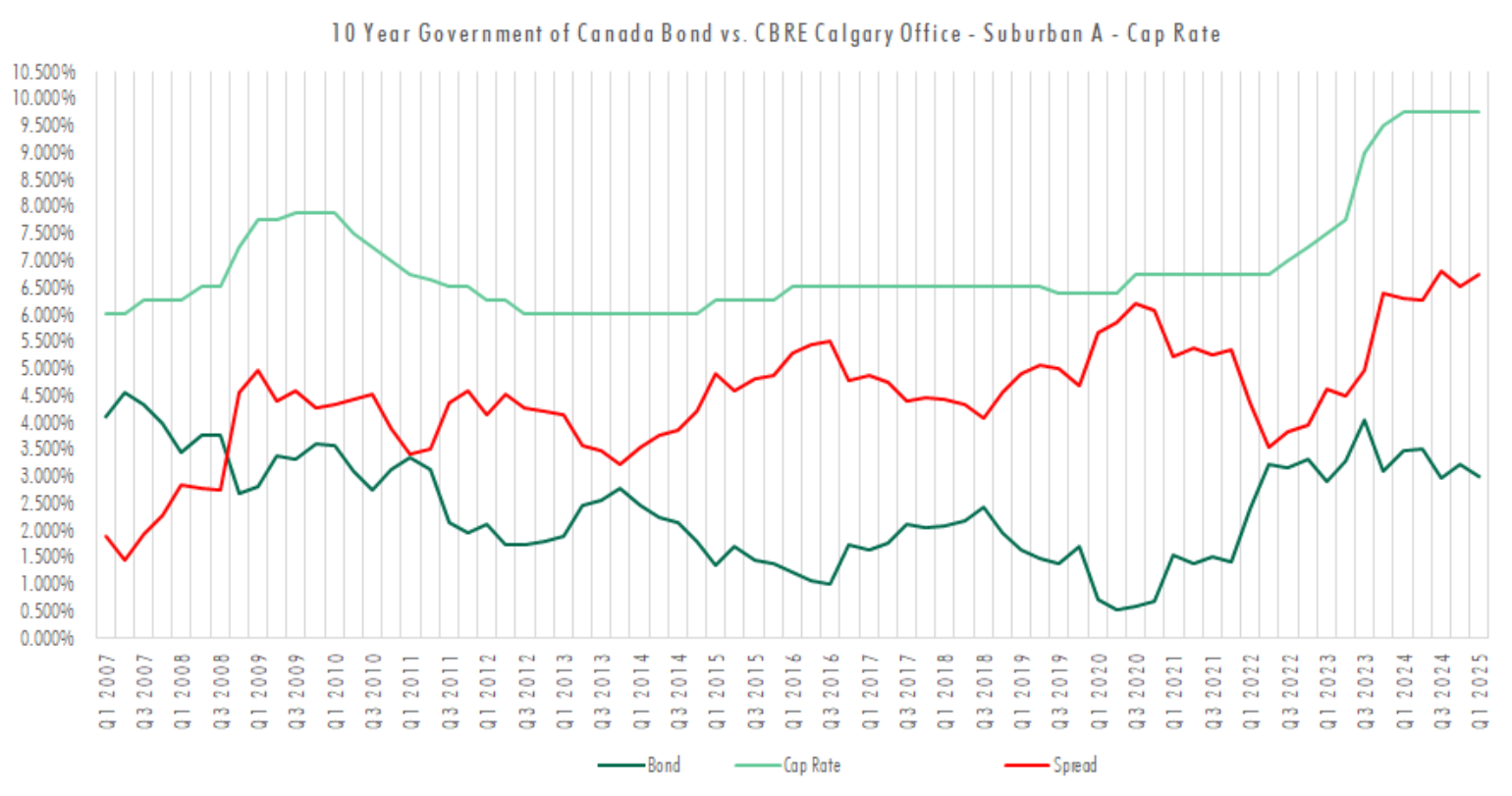

The spread between 10-Year Government of Canada bonds and suburban Calgary office cap rates is at a multi-decade high, exceeding 600 basis points in early 2025. Historically, this spread has averaged closer to 300–400 bps. This level of arbitrage is virtually nonexistent in other major cities.

Investors can acquire stabilized, fully leased suburban office assets at cap rates north of 12%, while financing remains below 6%, a rare spread in any market cycle. Even under today’s tight credit conditions, this creates day-one cash-on-cash returns exceeding 30% in stabilized, income-producing buildings with rising rents and falling vacancy. With no new supply in the pipeline, these yields are not only sustainable, they’re set to expand.

CBRE Research 2025

CBRE Research 2025

Calgary vs. the Rest of Canada: An Irrational Pricing Gap

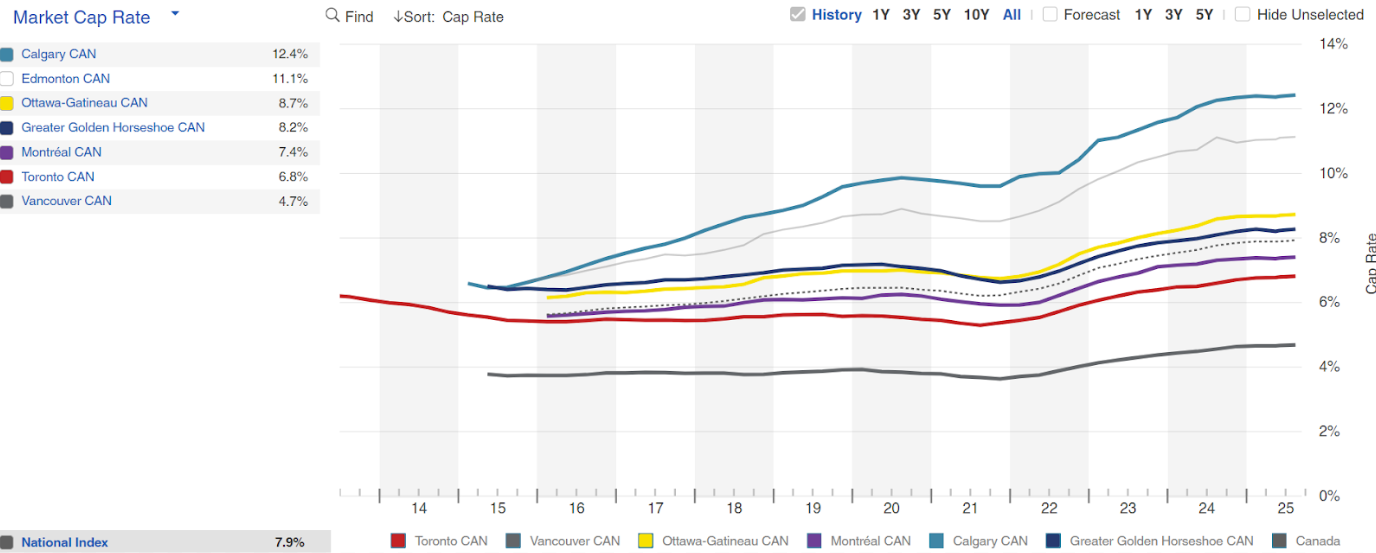

When viewed against other Canadian cities, Calgary’s office market appears significantly mispriced with cap rates dwarfing those of every other Canadian metro.

As of Q2 2025, verified across multiple sources including CBRE, Altus Group, and Colliers, Calgary’s downtown and suburban office markets are priced at historically wide spreads:

CoStar 2025

CoStar 2025

Downtown Class A Cap Rates (Q2 2025):

- Calgary: 13.0% – 15.0%

- Edmonton: 10.0% – 11.0%

- Winnipeg: 7.5% – 8.5%

- Toronto: 5.5% – 6.0%

- Vancouver: 4.75% – 5.50%

- Halifax: 6.5% – 7.25%

- Regina: 7.0% - 8.0%

Suburban Cap Rates (Q2 2025):

- Calgary (Suburban): 11.5% – 13.0%

- Edmonton (Suburban): 9.0% – 10.5%

- Winnipeg (Suburban): 6.25% – 7.25%

- Toronto (GTA West): 5.75% – 6.25%

- Vancouver (Suburban): 4.55% – 5.25%

- Regina (Suburban): 6.5% - 7.5%

This pricing gap is not only real, it’s expanding. Calgary’s cap rates are over 700 - 950 basis points above the GTA West suburban average and 750 - 1,025 basis points higher than Vancouver. Yet the fundamentals of Calgary’s suburban markets tell a sharply different story:

Vacancy in Northwest Calgary: 2.5% Sublease Inventory: 11% of city total (very low) Net Absorption (TTM): +190,000 SF Average Sale Price: $191/SF Estimated Replacement Cost: Over $500/SF

CoStar 2025

CoStar 2025

Comparatively, suburban Toronto vacancy sits near 19.7%, and London, Ontario reports suburban vacancies over 31.4%. Even Edmonton’s suburban markets are over 23% vacant. Calgary stands alone in offering high yield with low vacancy and no meaningful supply pipeline.

So why the dislocation? The answer is stigma.

Institutional capital pulled out post-2014 due to oil volatility. Then came pandemic-era remote work and ESG-driven exits. Calgary’s brand was bruised, not its balance sheet. Fundamentals have quietly rebounded while pricing remains stuck in a distressed cycle. This isn’t a pricing error, it’s a branding error. Calgary’s cap rates aren’t reflecting performance; they’re reflecting perception. The city’s suburban markets are outperforming on every metric except capital flows.

This creates a rare and powerful opportunity. When reputation recovers, and it will, yields will compress, and valuations will normalize. Until then, Calgary offers one of the last remaining pockets of true arbitrage in North American real estate.

For those willing to lean into the fundamentals rather than the fear, the return profile speaks for itself.

The Institutional Exodus and the Opportunity Left Behind

The risk narrative is not entirely unfounded, but it’s been exaggerated and misunderstood. Calgary’s office sector has been hit by a perfect storm, one that created a short-term collapse but a long-term opportunity.

1. The 2014 Oil Price Crash: Crude oil fell from over $100/barrel to under $30 by early 2016. This collapse gutted downtown Calgary’s energy-centric office demand. Major firms like Cenovus and EnCana (now Ovintiv) slashed headcount, exited leases, or relocated headquarters. According to the Calgary Chamber of Commerce, over 40,000 energy sector jobs were lost between 2014 and 2016.

2. The 2020 Pandemic and WFH Shift: COVID-19 accelerated the remote work trend, especially in knowledge sectors. Major tenants like Shell and Suncor downsized their downtown footprints. Sublease inventories ballooned. By mid-2021, CBRE reported that nearly 4.5 million SF of downtown space in Calgary was either vacant or on the market.

3. 2023 Interest Rate Spike: The Bank of Canada raised its policy rate from 0.25% in 2022 to over 5% by 2023. Office asset values plummeted as cap rates adjusted and financing tightened. Pension funds like PSP Investments and Oxford Properties began pulling out of riskier office investments nationwide. Capex-heavy downtown assets with flat rent rolls became unfinanceable.

4. ESG and Net-Zero Mandates: Institutional portfolios faced rising pressure to meet sustainability goals. Calgary’s downtown office stock, some dating back to the 1970s—required enormous investment to meet new carbon and energy expectations. Instead of upgrading, many funds opted to divest. In 2023, QuadReal and Cadillac Fairview made headlines by pausing acquisitions in non-core markets and prioritizing “decarbonization” of trophy assets in Toronto and Vancouver.

5. Charter A Lending Freeze: Anecdotally, one of the most underappreciated forces keeping Calgary’s office market undervalued is the near-total retreat of traditional lending. From first-hand experience and dozens of conversations with senior underwriters at RBC, ATB, BMO, TD, and CIBC, not a single one of the chartered banks is currently financing downtown Calgary office assets. Even suburban office deals, though fundamentally sound, are often being ignored or declined outright.

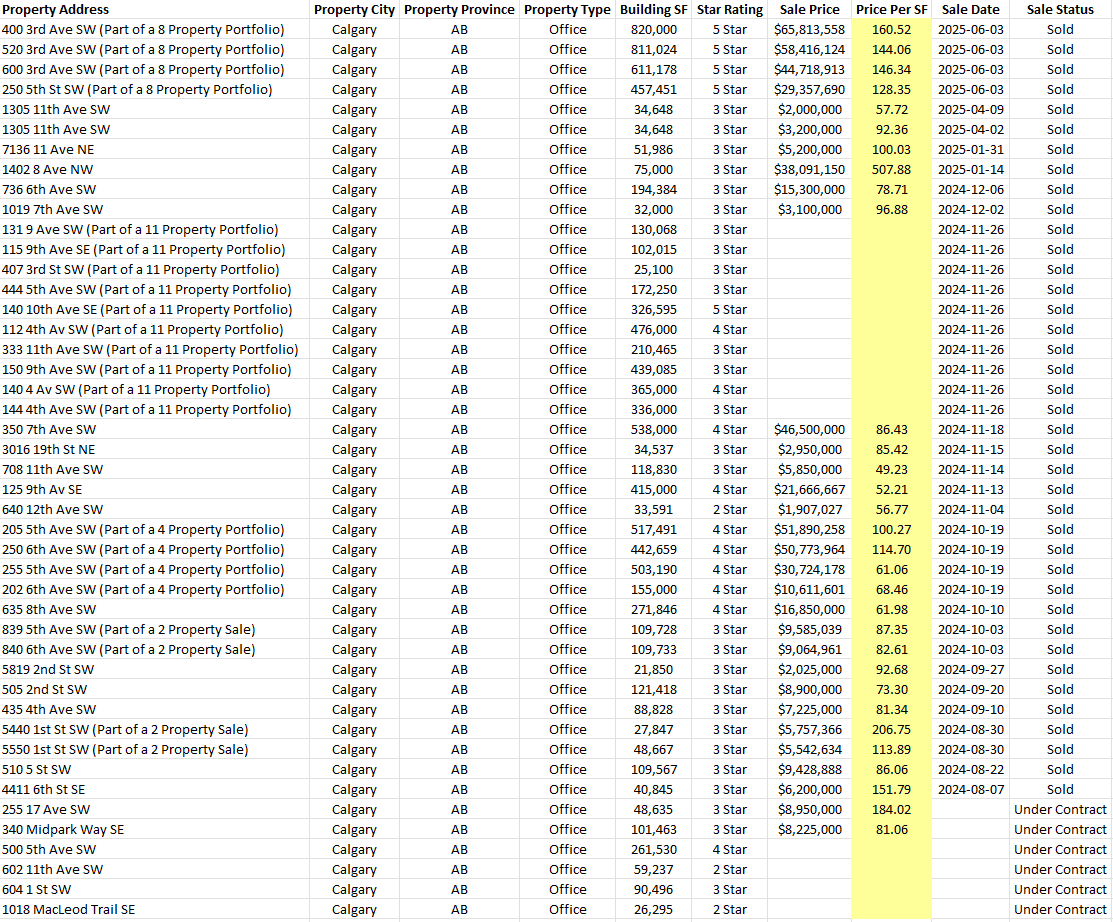

These overlapping forces triggered a wave of institutional selling. Fully stabilized assets were dumped at distressed prices. The vacuum left behind has been filled by a new class of buyers: private investors, family offices, and ultra-high-net-worth individuals. They aren’t constrained by ESG mandates, legacy cost bases, or redemption pressures. They’re underwriting real cash flow, not chasing narratives.

Last 12-month Calgary office transactions

Last 12-month Calgary office transactions

These buyers see what institutions overlooked:

- Assets are trading at $87–$200/SF, while replacement cost exceeds $500/SF.

- Leases are typically triple-net, with property taxes, insurance, and the majority of - structural capex passed through to tenants and amortized.

- Lease management fees support full operating teams for hands-on asset oversight.

- Smaller tenant footprints create leasing diversity and reduce rollover risk.

- Debt remains available through alternative lenders and private capital pools.

- Calgary, Canada’s strongest localized economy, leading the nation on every key metric

- Shrinking supply and soaring development costs driving sustained upward pressure on rents.

- Battle-tested tenants; those who endured every major headwind imaginable: oil booms and busts, COVID, high interest rates, and work-from-home shifts, U.S. tariffs … and are still standing, it’s fair to assume you’re here to stay.

This is textbook contrarian investing, buying when others are forced to sell, locking in double-digit yields on real income-producing assets, in a fundamentally sound, underappreciated market.

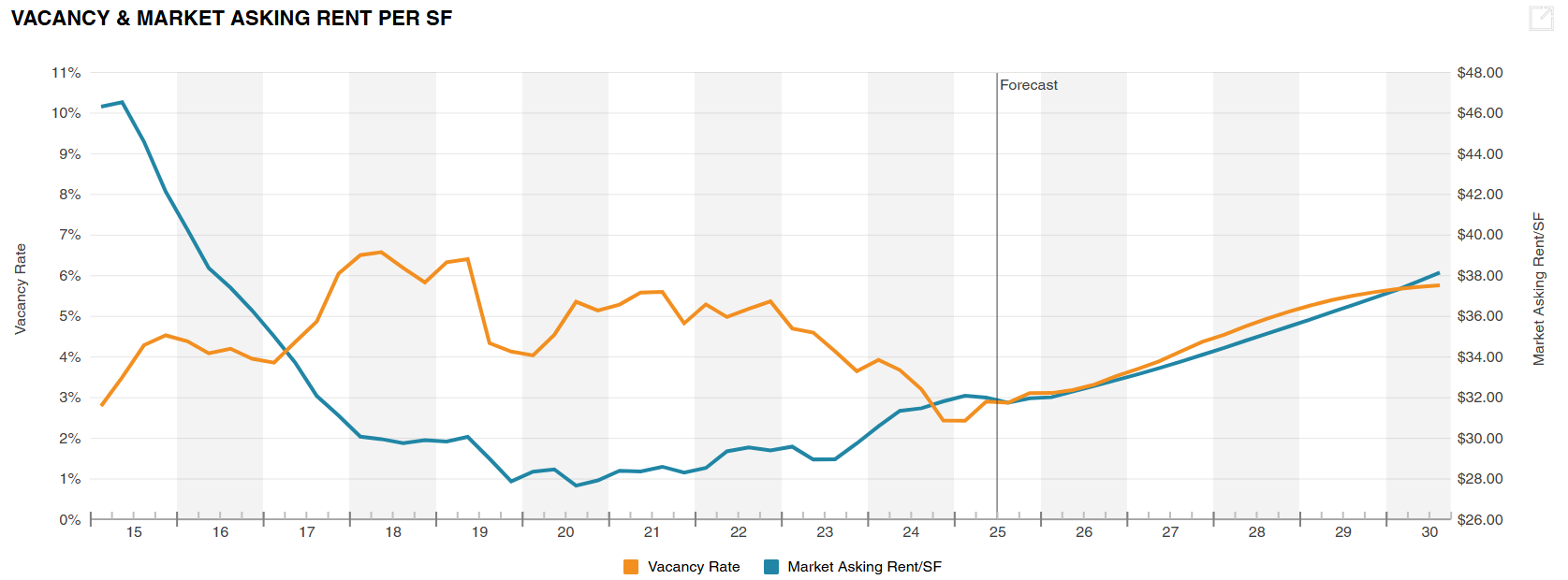

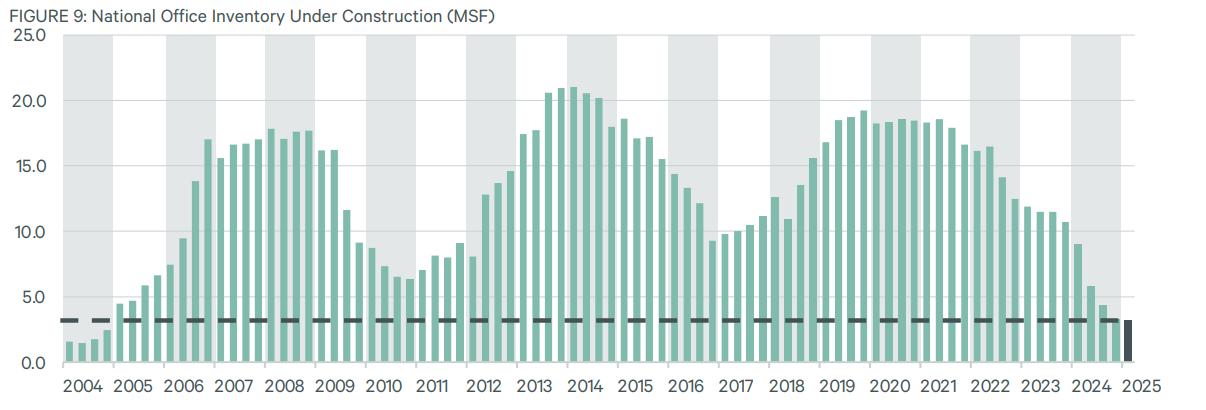

Supply is Shrinking. Literally.

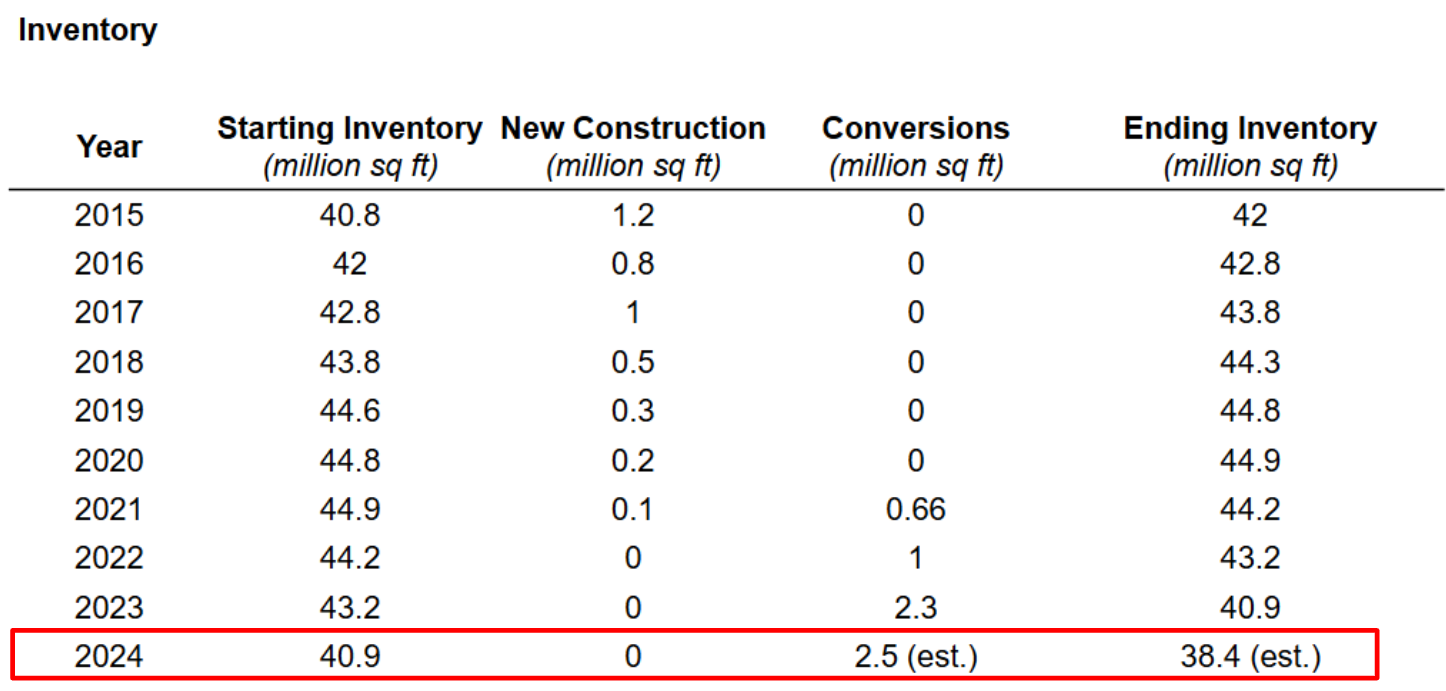

New construction is dead. As of 2024, suburban Calgary saw zero new office construction, a figure not seen since 2004. Instead of expansion, the city is in a state of controlled contraction.

Suburban Inventory (2024): 40.9M SF (down from 43.2M SF in 2023)

Downtown Conversions: Calgary’s office-to-residential conversion initiative is targeting 6 million SF by 2031, with over 1.7 million SF already approved or underway as of mid-2025

Between 2020 and 2024, Calgary lost nearly 3 million SF of office inventory, primarily in older B and C Class buildings. This shift is intentional, encouraged by city incentives and driven by economics. With replacement costs exceeding $500/SF and rents not yet supporting new development, new supply is fundamentally uneconomic and is likely to remain so for the next decade.

Unlike Toronto or Vancouver, where new towers are still being announced despite rising vacancy, Calgary’s market is shrinking by design. According to CBRE Q2 2025 data, suburban Calgary has the lowest pipeline of new supply among all major Canadian cities. National office construction fell to a 15-year low, but Calgary’s is virtually nonexistent outside of pre-leased, government-backed projects.

CBRE Research 2025

CBRE Research 2025

Meanwhile, absorption continues. Suburban submarkets like the Southeast posted +288,000 SF of net positive absorption over the past year, and Northwest posting 160,000 SF of net positive absorption over the past year.

City of Calgary Building Permit Data 2025

City of Calgary Building Permit Data 2025

This creates an unusual but powerful dynamic: no supply, steady demand, and rising occupancy. As tenants seek quality space in suburban nodes, Class A landlords will soon have pricing power in an environment where options are evaporating.

Every day, the supply is shrinking. The imbalance being created today will not be fixed tomorrow, and that’s what makes this setup so rare.

The Alberta Advantage: Fueling Demand

The macro backdrop is aligning perfectly for Calgary, and specifically for its suburban office market:

Strong Migration: Alberta led all provinces in net interprovincial migration for three consecutive years (2022–2024), with over 55,000 net new residents in 2023 alone, according to Statistics Canada. Many are young professionals and families relocating from more expensive provinces like Ontario and B.C., bringing both talent and purchasing power.

Income Growth: Alberta ranks near the top for median household income in Canada, at $104,000 in 2023 versus a national average of $84,000, per CMHC data. Wage growth in Calgary has outpaced inflation, driven by job creation in finance, logistics, and professional services.

Diverse Economy: Once reliant on oil and gas, Calgary’s economy is now diversified across multiple sectors. The tech ecosystem alone saw over $600 million in venture capital funding in 2023, a record high. Logistics, financial services, healthcare, and education are also experiencing strong employment growth.

Business Climate: Alberta has no provincial sales tax and some of the lowest corporate tax rates in Canada. The Fraser Institute has consistently ranked it the most business-friendly jurisdiction in the country. Calgary’s streamlined permitting and pro-growth policies make it a magnet for company expansions.

Affordability: Calgary remains one of the most affordable major cities in North America. The average home price in Calgary is ~$570,000 versus over $1.2 million in Toronto and $1.3 million in Vancouver (CREA, Q1 2025). This affordability advantage helps attract talent and retain businesses long-term.

Youthful Demographics: Calgary boasts the youngest median age (37.5) among Canadian major cities, with a highly educated, upwardly mobile population. This demographic profile is a strong demand signal for both employers and real estate investors.

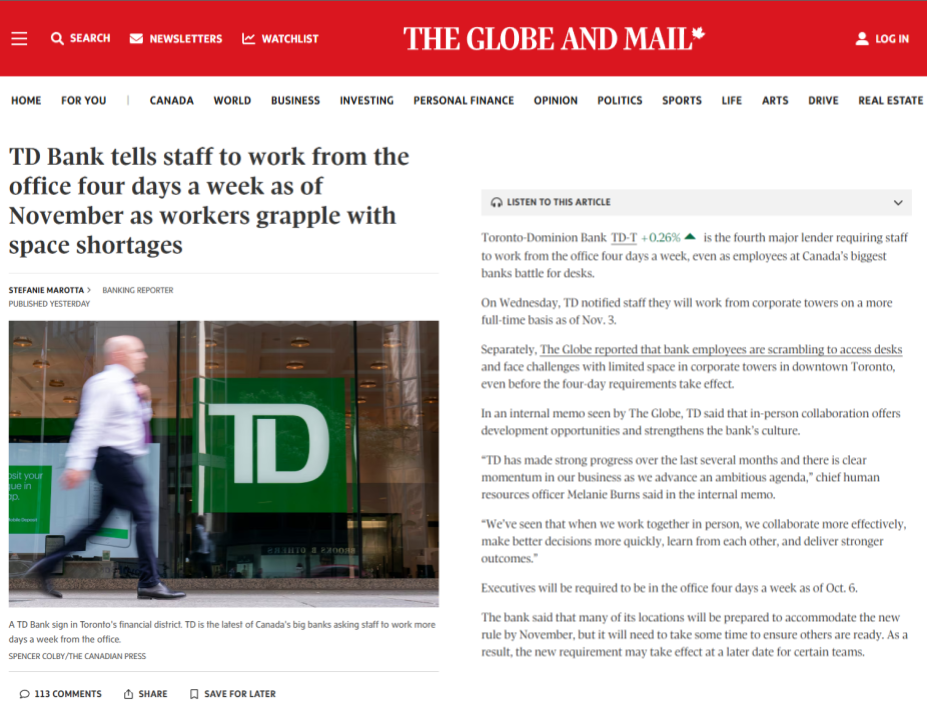

Return to Office Momentum: Nationally, over 60% of employers have implemented partial or full return-to-office mandates as of 2025, according to Colliers. Calgary is ahead of this curve, especially in suburban markets where short commutes, free parking, and smaller footprints make returning to work more appealing. Suburban absorption data and tenant mix reflect this behavioral shift.

As these tailwinds gain momentum, suburban Calgary is uniquely positioned to benefit. Demand is rising in places where supply is frozen. For investors, this sets the stage for organic rent growth, tenant stickiness, and long-term capital appreciation.

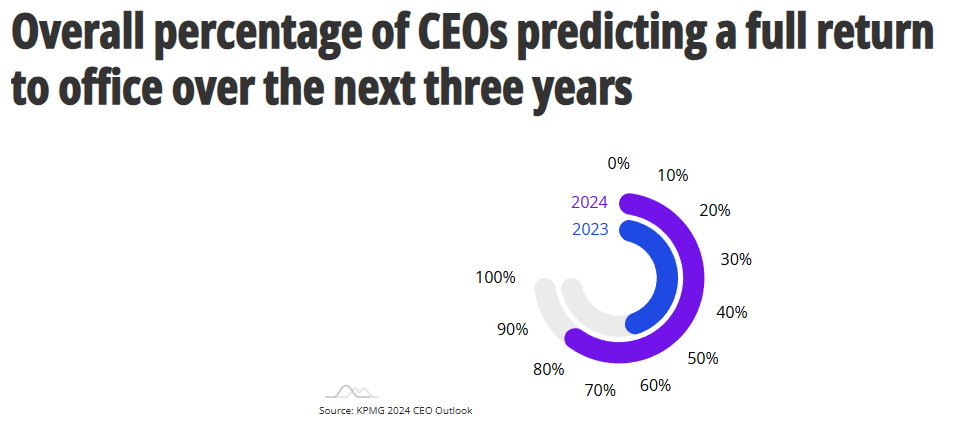

KPMG 2024 Survey Outlook Report - Over 1,300 CEOs reported that 83% expect a full return to the office within three years, up from 64% in 2023.

KPMG 2024 Survey Outlook Report - Over 1,300 CEOs reported that 83% expect a full return to the office within three years, up from 64% in 2023.

As return-to-office mandates continue to make headlines, they’re not the real driver behind office market recovery. What matters is economic growth. When businesses grow, they lease more space. That underlying demand has a much greater impact than whether office attendance hits 60% or 75%. It’s the strength of the economy, not the policies that moves the market.

Lending Freeze and the Capital Turnaround

This retreat is not solely due to fundamentals—it’s risk perception. Lenders are pricing in reputation, not cash flow. Understandably, after years of negative headlines, WFH fears, and collapsing institutional pricing, credit departments are erring on the side of caution.

But this lending freeze is also throttling capital flows. Without mortgage leverage, institutional buyers can’t underwrite competitive returns. That void only deepens the discount, limits buyer pools, and prolongs the mispricing.

And yet, this is precisely what sets up the inflection point.

The moment sentiment shifts, and it will, the capital faucet will return. As risk appetite stabilizes and lenders see rent rolls holding and absorption climbing, debt will re-enter the market. And when that happens, cap rates will compress rapidly.

The same dynamic applies to institutional capital. Canadian pension plans and real estate funds are funded by, and for, Canadian taxpayers. They have asset allocation mandates to deploy capital domestically. Calgary has always come back into favor once yields cross a high enough threshold.

This is a cycle Calgary has seen before. The post-1980s oil bust. The 2009 recession. The 2014 commodity collapse. In every case, the rebound followed a steep withdrawal of capital and was led by private investors who moved in ahead of institutional sentiment.

At some point, the yield is simply too compelling to ignore. And when the buying wall forms, led by institutions, stabilized lending, and a wider buyer pool, that’s the floor. It’s not a matter of if. It’s a matter of when.

The Bottom Line: Asymmetric Risk, Outsized Reward

You can now buy Class A, fully leased office buildings in prime suburban locations for $150–$200/SF. Replacement costs sit north of $500/SF, making new development uneconomic. You earn double-digit yields with no supply risk. Leases are net, tenant mixes are sticky, and sublease inventories are low.

All while institutions remain on the sidelines.

This is not just a value play. It’s not just a yield play. It’s a rare moment when capital, timing, and fundamentals align. Calgary’s suburban office market may well be the most compelling risk-adjusted real estate opportunity in North America today.

Ignore the noise. Follow the numbers. And invest where others won’t .. yet.

Half the Price, Double the Conviction

Acting on my prediction of market dislocation in Calgary’s suburban office sector, Sept 2nd, my partners and I will become the new owners of on a four-storey and seven-storey office complex in NW Calgary, totaling 120,000 SF with a 200+ stall underground parkade constructed in 2000 and 2006.

The asset is 100% occupied across 14 tenants with a WALT of five years, generating $2.5 million in annual NOI plus $250k per year in bonus amortization recovery. 13% going in cap on in-place income, excluding amort. recovery.

We paid $19.15 million, less than half of the $46.5 million the previous insitutional owner paid in 2014.

Stay tuned, we’re expanding our footprint in Calgary’s suburban office sector. With more opportunities than available funds, we’ll be seeking capital partners this year. Reach out if you’re interested in being part of this once-in-a-generation buying opportunity.